Quick links

T4

DCHP-2 (Dec 2012)

Spelling variants:T-4, T-4 slip, T4 slip

n. & adj. — also often in compounds, Administration

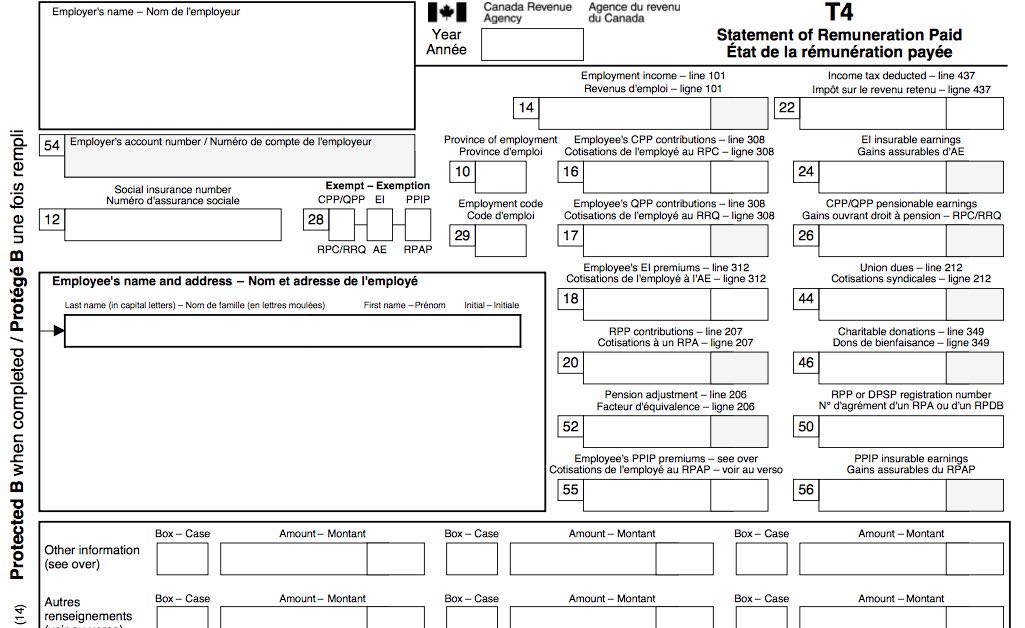

an annual statement of employment income for tax purposes (see Image 1).

Type: 1. Origin — Until the early 1970s, T4 was almost invariably spelled T-4. In the mid-1970s the hyphen was dropped to yield "T4" (see the 1978 quotation), which is today's standard form. T4 slips are needed to report one's income from regular employment on the Canadian tax return, which is generally due by 30 April of the following year. Other kinds of income are reported on other forms, such as T4As for grants or T4Es for employment insurance income including parental leave (see, e.g. the 2008 quotation). T3 or T5 slips (see the 2007 quotation) relate to investment income. Chart 1 shows the term's prevalence in Canada.

See also COD-2, s.v. "T4", which is marked "Cdn."

See also COD-2, s.v. "T4", which is marked "Cdn."

Until the 1970s, the spelling with the hypthen, T-4, was the standard form (see quotations).

Quotations

1956

Our managers earn upwards of 25,000.00 yearly (1955 T-4's on file). Our business is home field selling -- is depression proof -- maintains international supremacy in its product field.

1966

Remember where you put it.

Your personalized Income Tax form is mailed to you in January.

Your T-4 slips will be in your hands before the end of February. Use your personalized return. You'll get your refund faster.

"Is this the year I fill out my tax right?"

DEPARTMENT OF NATIONAL REVENUE

The Hon. E.J. Benson, Minister

1978

Number of dependents

The mother will receive a TFA slip (similar to a T4) probably with her January family allowance cheque, which will show the number of dependents for whom the tax credit can be claimed. Four copies will be received, one to be filed with the mother's tax return, one to be filed with her husband's return, and two more to be kept for the two peoples' records.

1996

The tax-deductible amount will appear on the donor‘s T4 slip, meaning there is no danger of losing a receipt.

2007

Generally, you need to complete a T4 slip if you are an employer and you paid your employees employment income, commissions, taxable allowances and benefits, or certain other payments. See When to complete a T4 slip.

For amounts that should not be reported on a T4 slip, see Exceptions.

If you are an employee who has not received your T4 slip or you have questions about amounts, contact your employer or see Information slips.

2007

Line 120 --Taxable amount of dividends from taxable Canadian corporations As a result of the new dividend regime for 2006, there are now two types of dividends: "eligible" and "other than eligible" dividends. Your T3 or T5 information slips will clearly indicate the type of dividends you received in 2006.

2008

In the second scenario, if the EPI consists of benefits from an employer's registered pension plan (RPP) that appear on a T4A slip, then a transferee spouse will have new income that can qualify for the pension credit (worth $410 in Saskatchewan).

References

- COD-2

- COD-1

Images